The maritime surveillance market is poised for substantial growth, with projections indicating an increase in value from approximately USD 21.9 billion in 2023 to an estimated USD 42.7 billion by 2033. This growth trajectory represents a compound annual growth rate (CAGR) of 6.90% over the projected period from 2024 to 2033. According to a report by Market.us, the rise in market value is primarily driven by escalating investments in maritime security technologies, increased global trade, and growing concerns regarding illegal activities in international waters.

In 2023, North America emerged as a leading player in the market, accounting for over 34.1% of the share and generating revenues of USD 7.9 billion. This dominance is attributed to the region's advanced maritime infrastructure and significant investments in surveillance technologies. The United States, with its extensive coastline and status as a global maritime trade capital, necessitates sophisticated systems to secure its ports and vessels. Government spending has particularly focused on maritime security technologies such as radar systems, satellite surveillance, and automatic identification systems (AIS).

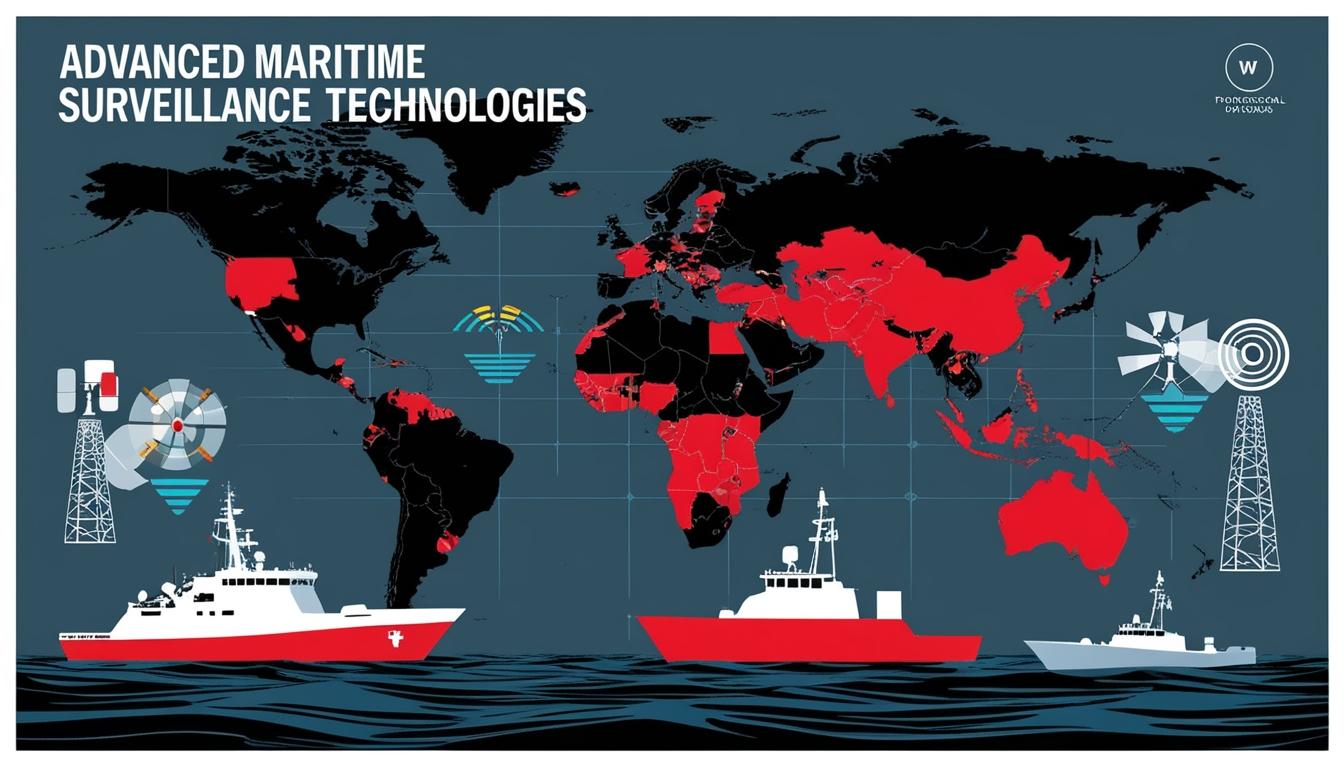

The growing geopolitical tensions and the imperative of securing maritime routes have led to increased demand for comprehensive surveillance solutions that offer real-time data and enhanced situational awareness. This growth is complemented by ongoing technological innovations, including advancements in autonomous vessels and AI systems capable of interpreting vast amounts of oceanographic data.

In 2023, the solutions segment dominated the market, holding over 75.1% of the total share, largely due to the widespread implementation of advanced technologies like radar systems and satellite tracking solutions. Meanwhile, the surveillance and tracking segment accounted for over 34.0% of the market share, including tools designed for monitoring vessels and ensuring compliance with regulations.

The military and defence segment was notably the primary driver of market growth, capturing over 59.5% of the market share in 2023. This is largely due to the essential role of maritime security in national defence initiatives, prompting countries to invest heavily in surveillance systems to protect territorial waters and monitor potential threats.

Emerging technologies are transforming the maritime surveillance landscape. Indian space tech start-up PierSight recently launched the Varuna satellite, which offers continuous monitoring capabilities across oceans, promising to cover up to 100% of marine areas with revisit intervals of as short as 30 minutes. Additionally, the development of autonomous drones, both aerial and underwater, is expanding the operational reach and efficiency of surveillance, covering vast areas that were previously inaccessible.

The maritime surveillance sector is now also addressing environmental concerns. Technologies are being employed not only for security but also for monitoring maritime ecosystems and mitigating environmental threats. The integration of AI and machine learning plays a critical role in detecting illicit activities by identifying patterns and anomalies in maritime behaviour.

There are key opportunities for expansion in developing regions, where investments in maritime security are rising. The adoption of integrated surveillance systems that combine various sensor technologies with advanced analytics is anticipated to enhance tracking capabilities and enable faster response times, essential for effective maritime security operations.

However, challenges persist within the maritime surveillance sector. The vastness of oceanic spaces poses difficulties in comprehensive monitoring, often resulting in coverage gaps. Harsh environmental conditions can impact the functionality of surveillance equipment, while data integration from multiple sources requires sophisticated systems and skilled personnel, which can strain organisational resources.

Despite these challenges, the benefits of maritime surveillance for businesses in shipping, fisheries, and coastal operations are significant. Enhanced operability through real-time vessel monitoring leads to optimised routing and reduced operational costs. Furthermore, surveillance systems protect assets from illegal activities and help in compliance with regulations, while the accumulated data can be leveraged to predict trends and inform strategic business decisions.

In summary, the maritime surveillance market is crucial for ensuring maritime security in an era of escalating geopolitical tensions and evolving technological capabilities. With ongoing innovations in satellite imaging, AI, and integrated surveillance systems, there are substantial opportunities for growth and development within the sector. As the importance of global maritime routes continues to rise, the need for robust surveillance solutions to protect both maritime domains and the economic activities linked to them will increasingly come to the forefront.

Source: Noah Wire Services