In an era marked by rapid technological advancement, the payments landscape is undergoing a significant transformation, propelled by innovations in artificial intelligence (AI) and automation. Several emerging payment systems are being introduced globally, changing how consumers and businesses engage with financial transactions.

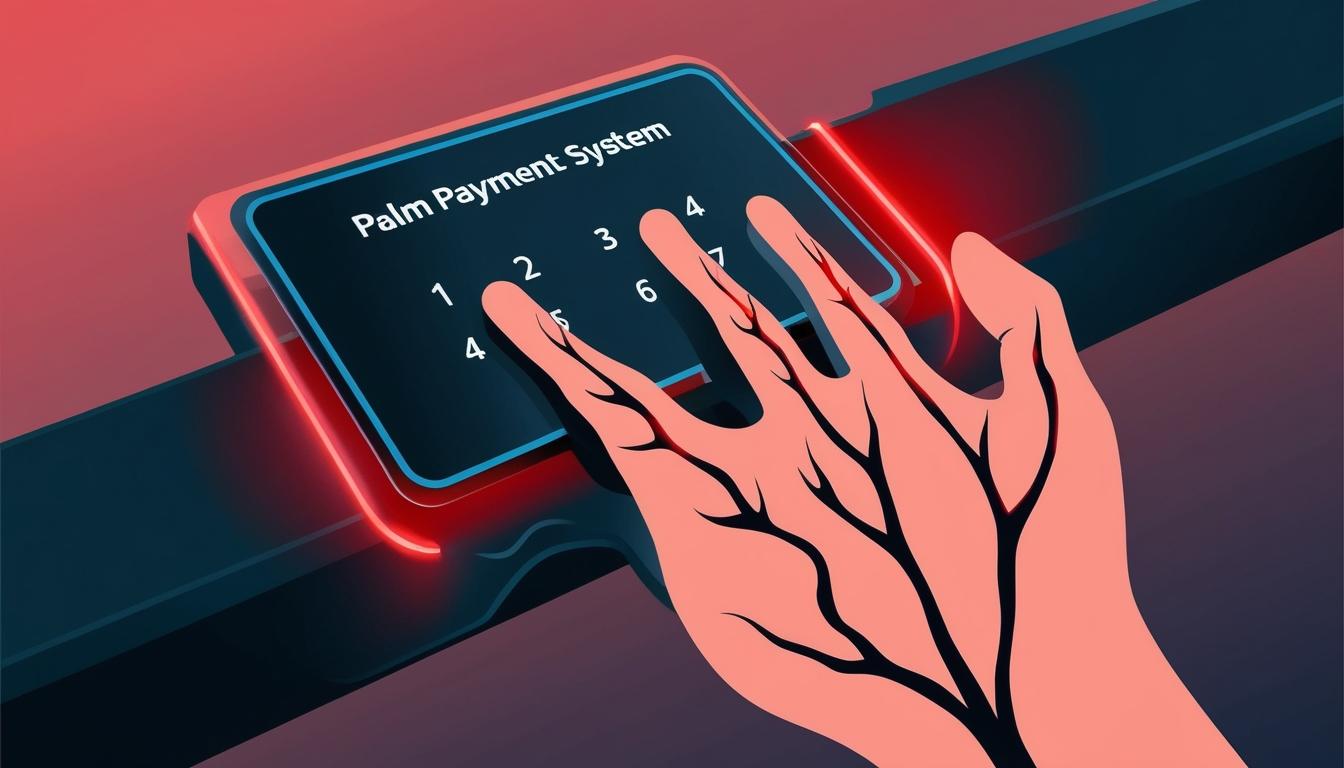

Tencent's Weixin has launched a palm recognition payment system that utilises the unique vein patterns in an individual's hand for secure transaction authorisation. This technology scans and encrypts the vein patterns, linking them to a Weixin Palm Payment account. As retail and dining sectors in China begin adopting this innovative payment method, it is gaining traction and is expected to expand internationally. The palm vein recognition technology is lauded for its high security, being a highly accurate biometric system that can distinguish between individuals, even identical twins.

In the realm of voice-activated payments, Amazon’s Alexa Pay has introduced a method where transactions can be completed simply by speaking. Users can link their Amazon accounts to Alexa-enabled devices and create a personal voice profile to ensure only authorised users make purchases. Alexa employs machine learning and biometric voice identification for security, offering the option for a spoken PIN as an additional safeguard against unauthorised transactions. This technology is also making waves in India, where conversational payments are simplifying transactions through voice commands in multiple regional languages, facilitated by APIs from Payment Gateway and CoRover's BharatGPT.

The concept of wearable payments is gaining momentum, exemplified by CashCuff, which claims to be the world's first payment-enabled shirt. This garment integrates a Near-Field Communication (NFC) chip discreetly within its cuff, allowing users to transact by bringing the cuff into proximity with payment terminals. The NFC technology enables communication with payment systems wirelessly, linking to a prepaid MasterCard account managed by the user. This innovative approach presents an alternative to traditional wallets or mobile payments, providing a low-risk solution for consumers looking to travel light.

In a striking leap towards the future of payments, Walletmor is pioneering the integration of implantable NFC-based chips that can be placed beneath the skin, typically in the hand. These chips facilitate seamless contactless payments with a simple wave, relying on safe, FDA-approved biopolymer materials for durability and comfort. Operating using passive NFC technology, these implants do not require Wi-Fi or Bluetooth, thereby reducing risks of hacking. Unlike conventional payment methods, the payment data resides directly on the chip, presenting a privacy-oriented solution. However, concerns remain regarding potential malfunctions, the need for replacements, and the practicality and cultural acceptance of implantable payment technologies.

The rapid evolution of payment technologies encapsulates a broad spectrum of innovations ranging from biometric systems to wearable devices, reflecting a shift towards a more convenient, fast, and secure transaction method. As these technologies become more mainstream, they also introduce critical considerations regarding privacy, accessibility, and consumer trust. The payments landscape is poised for a future where simplicity and security come to the forefront, reshaping the traditional interactions between consumers and businesses. Those involved in the industry will need to navigate these dynamic changes while addressing the lingering questions about their broader implications.

Source: Noah Wire Services