On Thursday, U.S. stock markets witnessed a minor decline, with the S&P 500 and NASDAQ both showing slight decreases. The S&P 500 closed down by 0.04% at 6,037.59, while the NASDAQ experienced a 0.05% dip, finishing at 20,020.36. Conversely, the Dow Jones Industrial Average managed a modest uptick of 0.07%, concluding the day at 43,325.80.

Amidst this mixed trading session, several stocks garnered considerable attention from retail traders and investors, leading to notable fluctuations in their values.

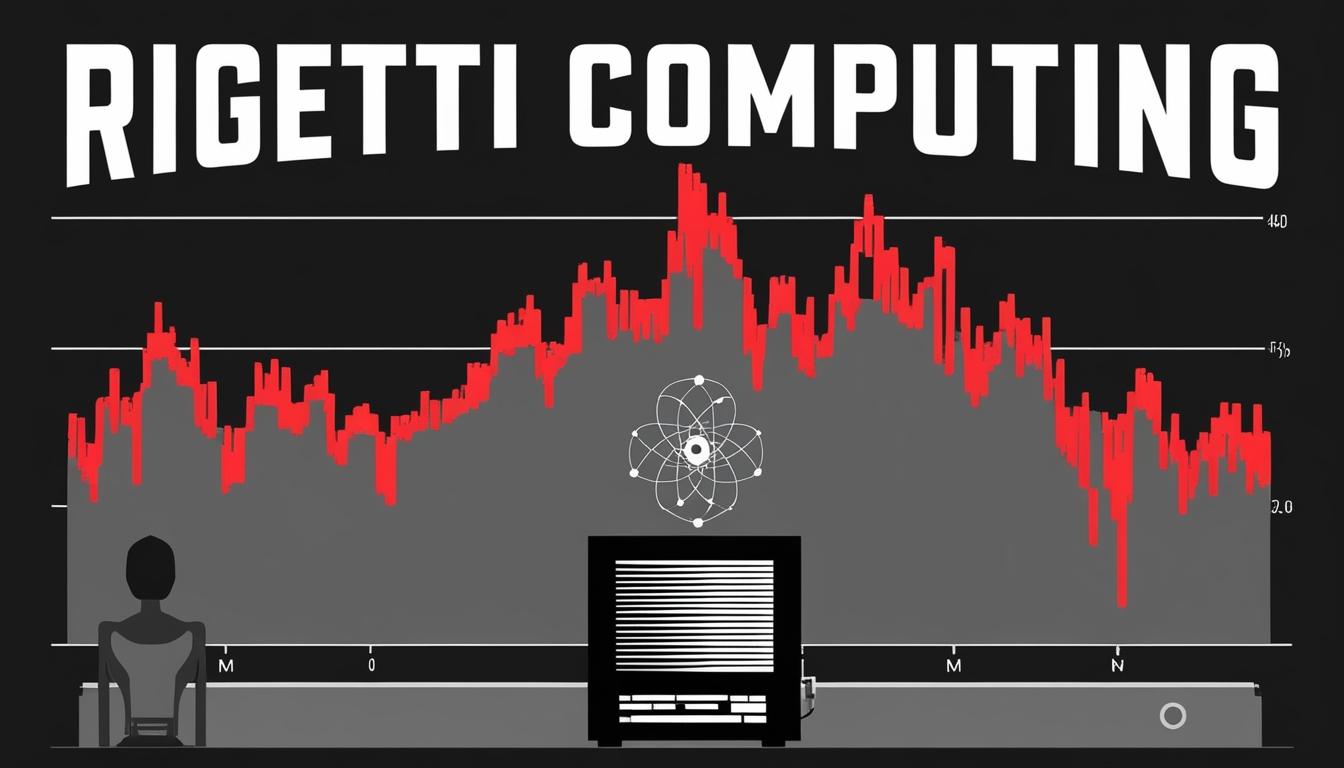

Rigetti Computing Inc. saw an impressive rise of 36.04%, with its stock closing at $15.44 after hitting an intraday peak of $15.50 and a low of $10.76. The company's shares have fluctuated in a 52-week range of $0.66 to $15.50. The spike in Rigetti’s stock price can be attributed to the launch of its new 84-qubit Ankaa-3 quantum computer, which features enhanced hardware capabilities. Investors appear increasingly focused on the potential of quantum computing, pushing the stock to an all-time high during the trading day.

GameStop Corp. also caught the investor spotlight, with its shares appreciating by 5.94% to close at $32.99. The stock fluctuated throughout the day, recording a high of $34.37 and a low of $31.60. The 52-week range for GameStop stands between $9.95 and $64.83. The uptick in price was reportedly influenced by a Christmas post from prominent investor Roaring Kitty, also known as Keith Patrick Gill, which reignited interest among traders.

Palladyne AI Corp. experienced a phenomenal gain of 47.57%, closing at $7.29. The stock hit an intraday high of $8.86 and fell to a low of $6.30, trading within a 52-week range of $1.26 to $8.86. This surge came on the heels of the company’s announcement regarding a successful autonomous tracking flight using its innovative Palladyne Pilot AI software, which has attracted significant attention within the tech community.

Phunware Inc. saw a notable increase of 27.91%, with a closing price of $5.50. Throughout the trading day, the stock reached a high of $5.63 and a low of $4.29, with its 52-week trading range spanning from $2.85 to $24.01. The volatility observed in Phunware’s stock price is linked to its association with President-elect Donald Trump and the company’s ambitions for global expansion.

In contrast, Tesla Inc. faced a slight decline of 1.76%, closing at $454.13. The stock’s intraday movements included a peak of $465.33 and a low of $451.02, while it has a 52-week range from $138.80 to $488.54. Tom Zhu, Tesla’s Senior Vice President of Automotive, has emphasised the company's preparedness to efficiently produce autonomous vehicles as the Shanghai Megafactory approaches completion, although this announcement did not prevent the day’s minor drop in stock price.

Overall, the trading day showed a complex interplay of stock movements reflecting ongoing investor interests in emerging technologies and market dynamics, as reported by Benzinga.

Source: Noah Wire Services