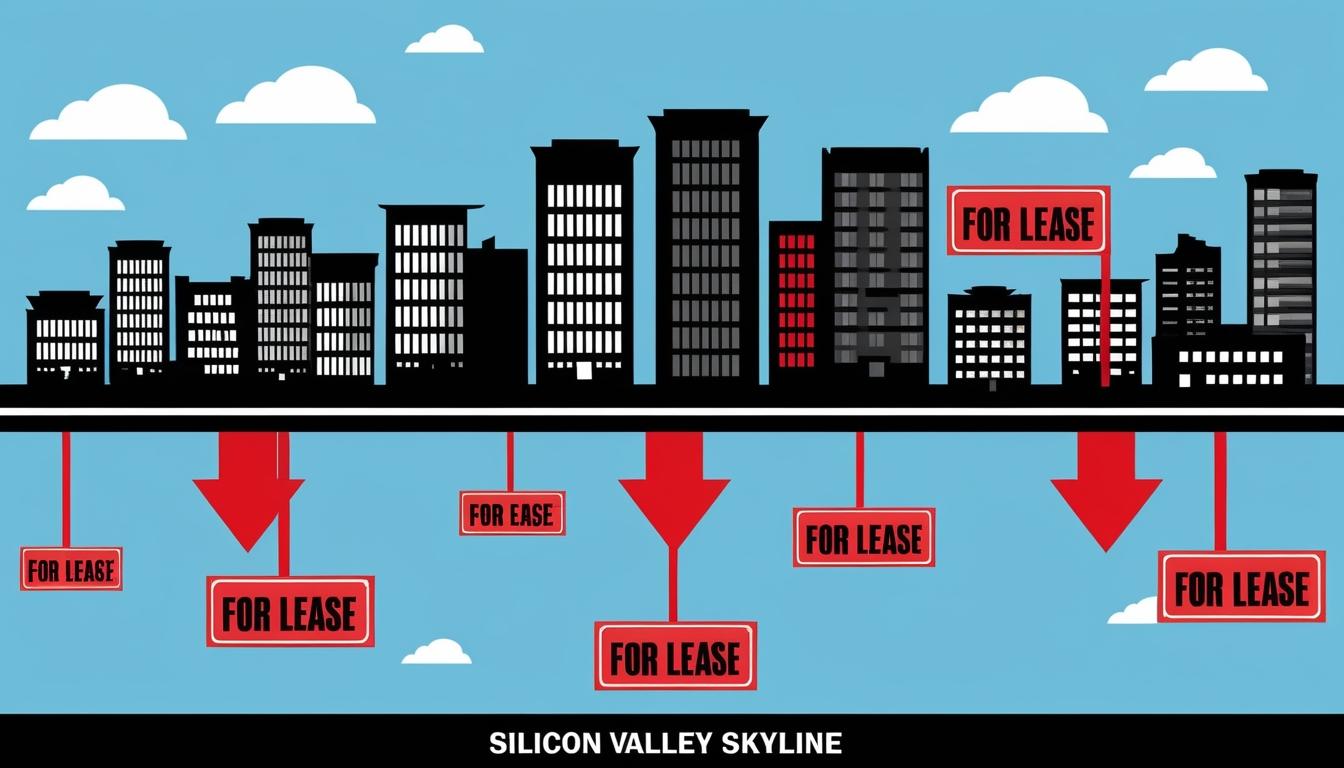

In the Silicon Valley area, the commercial real estate landscape is undergoing significant changes as companies adapt to an evolving workforce's preferences concerning office space. A December report compiled by Joint Venture Silicon Valley and commercial real estate firm JLL Silicon Valley highlights an increase in commercial vacancy rates alongside a resurgence in development activities.

The report illustrates a stark rise in vacancy rates across various sectors, with figures indicating a 24.6% vacancy in lab spaces, 11.1% in research and development, and 4.7% in industrial sectors. The office space vacancy rate has experienced a notable increase to 21.8% in the third quarter of 2024, up from 19.6% in 2023 and more than double the 8.6% vacancy rate recorded in 2019.

The findings cover commercial real estate trends in Santa Clara and San Mateo counties, as well as in Fremont and Newark. Russell Hancock, CEO of Joint Venture Silicon Valley, characterised this phenomenon as “the paradox of 2024,” stating, “The paradox is that we have a growing economy and less need of space.” The report suggests that, despite rising new development, employees are hesitant to return to the office full-time. The San Jose metro area reports a low return-to-office rate of 40.7%, one of the lowest in the nation.

This trend is attributed, in part, to the increasing prevalence of remote work, as individuals are seeking better work-life balance while living outside the Bay Area. Hancock noted that the rising costs of living and housing in Silicon Valley have significantly contributed to this shift. “Now people have found that they can have it both ways, with the high pay and the opportunities and changing the world,” Hancock said to San José Spotlight. “They can do that, and they can live in a house. They can do both.”

In terms of new developments, the ongoing increase in construction has reached a post-pandemic high, with about 9 million square feet of new commercial space added in 2024 compared to 6.4 million in 2023. Despite higher vacancy rates, existing demand for lab and industrial spaces continues to flourish, suggesting that sectors requiring physical presence are less affected by the broader trends in remote work.

There seems to be a disconnect between the demand for space and shifting employee dynamics. Hancock expressed uncertainty surrounding the causes of this juxtaposition, noting, “I think there will just be continuous evolution. Right now, we’re in this place where people are de-emphasizing place, and accenting connectivity and disbursed models.”

Land use consultant Bob Staedler echoed this sentiment, predicting a recovery in the commercial real estate market in the near future. Staedler remarked that the commercial landscape in San Jose remains comparatively stable, with fewer companies defaulting on their loans compared to San Francisco.

Moreover, the report suggests that existing commercial spaces may recover more quickly than new buildings, as businesses look to downsize or relocate to more cost-effective options. However, Staedler emphasised the need for cautious optimism, stating, "I don’t think we’re going to know what the new normal is for another year.” He highlighted the importance of monitoring vacancy rates, aiming for a decline below 20%, as a crucial indicator for business forecasts in the commercial real estate sector moving forward.

While the implications of these trends remain to be fully understood, the current climate is characterised by a growing tension between the demand for flexible work arrangements and the ongoing construction of commercial properties within the region.

Source: Noah Wire Services