The Asian Development Bank (ADB) and Gulf Renewable Energy Company have concluded an $820 million loan agreement to support the construction of 12 renewable energy projects in Thailand. The initiative is a significant move in the country's ambition to increase its renewable energy capacity, targeting a goal of achieving 50% renewable energy output by 2037.

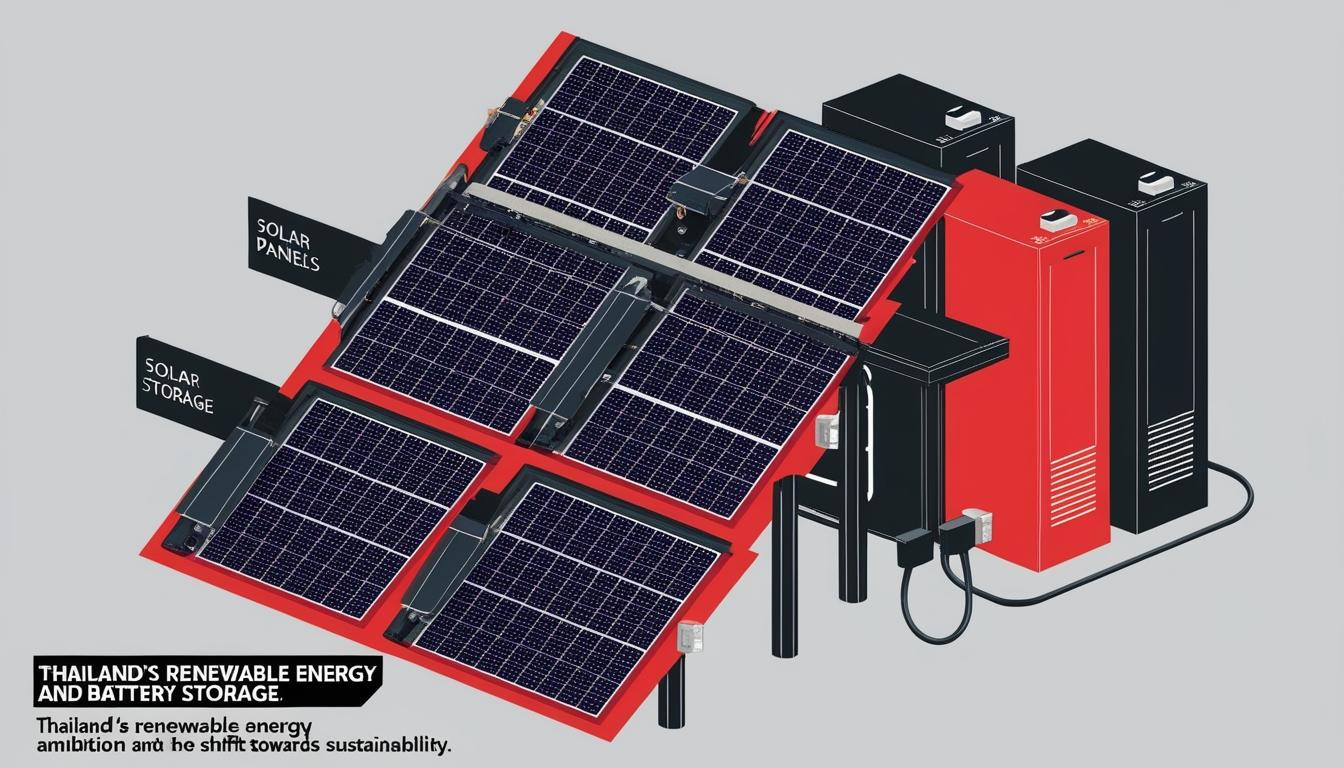

The projects involve the development of eight ground-mounted solar photovoltaic (PV) plants and four solar PV plants paired with integrated battery energy storage systems (BESS). The total capacity of the solar PV plants is 393MW, while the combined capacity of solar and BESS projects is estimated at 256MW and 396MWh of energy storage.

This financing is structured under Thailand’s renewable energy feed-in-tariff programme, which aims to double the country's installed wind and solar capacity by 2030. As the mandated lead arranger and bookrunner of the financing package, ADB is contributing $260 million from its own capital, complemented by $529 million in parallel loans from other international financial institutions. To further mitigate the risks involved with solar BESS projects, ADB will inject $31.35 million from the Clean Technology Fund.

Suzanne Gaboury, ADB's Director General for Private Sector Operations, remarked that these projects will significantly boost solar energy and battery storage capabilities in Thailand, which is a pivotal step towards carbon neutrality. “By integrating battery storage with solar power, these projects will help to provide clean energy during non-daylight hours, grid stability and facilitate further integration of solar power which will enhance Thailand’s energy mix,” she detailed.

Gulf Energy Development, which operates over 14.5 gigawatts (GW) of installed capacity in Thailand, echoes this sentiment. Its Chief Financial Officer, Yupapin Wangviwat, highlighted the importance of institutional support in mobilising necessary capital for large-scale projects, thereby contributing to Thailand’s overarching renewable energy goals.

In parallel, the medical technology sector is seeing significant shifts as well. Swedish MRI software developer SyntheticMR is set to acquire Finnish software company Combinostics for €4.3 million ($4.5 million), aiming to enhance its AI-driven solutions for diagnostic imaging, particularly for neurological disorders. The acquisition is expected to close in January 2025 and will be financed through a loan from SyntheticMR’s main shareholder.

SyntheticMR’s acquisition is designed to merge its capabilities in brain tissue characterisation with Combinostics’ advanced segmentation algorithms, addressing growing customer demands in neurodegenerative disorder diagnosis. The integration of their technologies is anticipated to develop a stronger predictive model that can identify and classify disease patterns. The company anticipates that the AI diagnostic imaging market will escalate to over $1.2 billion by 2027, driven by the increasing application of AI across healthcare.

Additionally, Baker Tilly International has appointed Nick Bull, an audit partner at Pitcher Partners in Australia, as the global head of audit. Bull's role will involve coordinating audit strategies across regions and leading business development efforts. He expressed enthusiasm for driving the global audit strategy, ensuring clients receive applicable and insightful assurance information for informed decision-making.

In a complementary expansion, Baker Tilly recently acquired Alirrium, which provides Robotic Process Automation (RPA) advisory and implementation services. This acquisition aims to bolster Baker Tilly's capabilities in RPA, AI, and machine learning, allowing it to support businesses in modernising their operations and enhancing their competitive positions in a rapidly advancing technological landscape.

These developments across various sectors signify the escalating trend towards automation, innovation, and sustainable practices within industries, reflecting broader shifts in business practices and technological advancements.

Source: Noah Wire Services