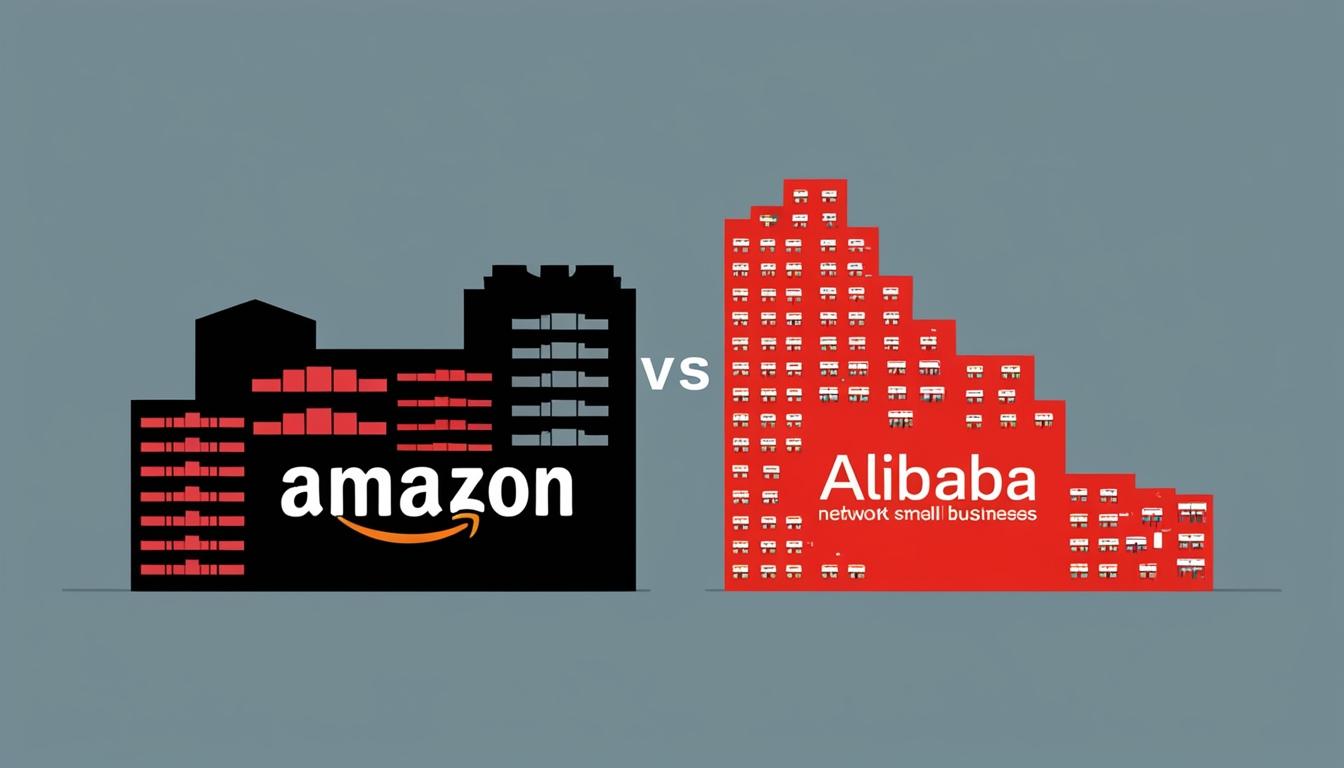

In the evolving landscape of e-commerce, Amazon.com, Inc. and Alibaba Group Holdings Ltd stand as two monumental figures, each characterised by distinct operational philosophies, business models, and strategic approaches.

Jack Ma, co-founder of Alibaba, in a 2017 interview with Andrew Ross Sorkin during the World Economic Forum in Davos, articulated the fundamental differences between the two companies. He described Amazon as being "more like an empire" that seeks to control various aspects of its operations. In contrast, he posited that Alibaba's philosophy is centred around empowering others, stating, “We can make every company become Amazon.” This highlights Alibaba's model of enabling other sellers and service providers to thrive rather than focusing solely on direct retail sales.

Currently, Amazon operates on an asset-heavy model, controlling a vast supply chain that includes warehouses, logistics, and even its own fleet of aircraft to facilitate rapid deliveries. The company's financial success is bolstered through direct product sales, subscription services such as Amazon Prime, and its cloud computing division, Amazon Web Services (AWS). For the last quarter, Amazon posted net sales of $158.9 billion, reflecting an 11% year-over-year increase, outperforming analyst expectations. Notably, North American sales rose by 9% to $95.5 billion, while international sales saw a 12% increase to $35.9 billion. AWS experienced significant growth as well, generating $27.5 billion with a 19% year-over-year rise.

In contrast, Alibaba adopts a more decentralised model, not owning warehouses or logistics firms. Instead, it relies on a network of partners that encompasses small businesses and service providers, thus creating an ecosystem where other entities can flourish. The e-commerce giant garners revenue through advertising, transaction fees, and various ancillary services, rather than direct product sales. Alibaba’s market performance in its fiscal second quarter of 2024 reveals a revenue figure of $33.70 billion, marking a 5% increase compared to the previous year and surpassing analyst forecasts. Additionally, revenue from Alibaba's international commerce retail segment surged by 35% year-over-year, reaching $3.65 billion, while its Cloud Intelligence Group contributed $4.22 billion, reflecting a 7% growth.

Despite differing philosophies, both companies have achieved remarkable valuations, with Amazon currently valued at approximately $2.335 trillion, making it the fifth most valuable company globally. Alibaba's valuation stands at $199.15 billion, showcasing significant enterprise value in the global e-commerce arena.

As organisations and analysts continue to observe these two titans, the implications of their contrasting business strategies may influence future trends in the e-commerce sector. The operational choices made by Amazon and Alibaba will likely serve as case studies for emerging businesses navigating this competitive landscape.

Source: Noah Wire Services